fulton county ga sales tax rate 2021

Average Sales Tax With Local. The minimum combined 2022 sales tax rate for Fulton County Georgia is.

How To Buy Tax Lien Certificates In Georgia For Big Profits

Code Jurisdiction Rate Type Code Jurisdiction Rate.

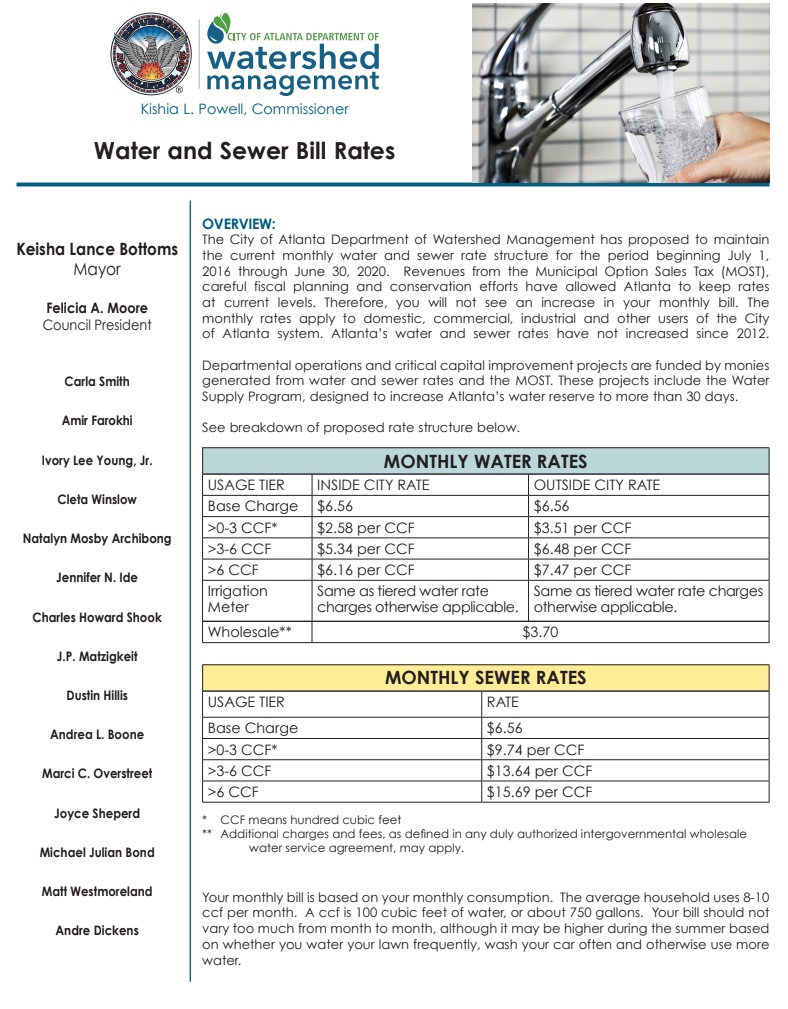

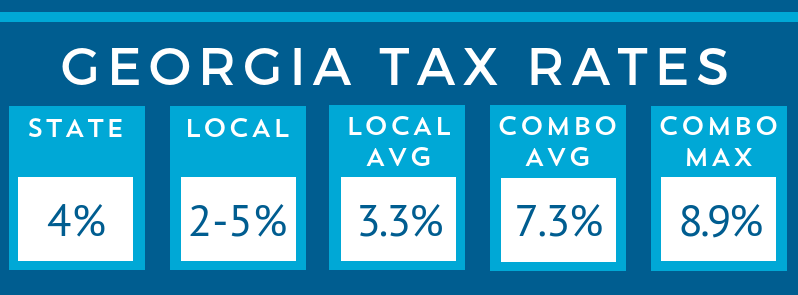

. Fulton County collects an additional 375 percent which is consistent with other metro Atlanta counties. Georgia state sales and use tax rate is 4 percent. The Fulton County Board of Commissioners does hereby announce that the 2021 General Fund millage rate will be set at a meeting to be held at the Fulton County Assembly.

The sales tax jurisdiction name is Atlanta. 890 Is this data incorrect. This is the total of state and county sales tax rates.

GEORGIA SALES AND USE TAX RATE CHART Effective January 1 2021 Code 000 - The state sales and use tax rate is 4 and is included in the jurisdiction rates below. Sales Tax - Upcoming Quarterly Rate Changes. Ferdinand is elected by the voters of Fulton County.

Rate Changes Effective October 1 2022 1627 KB Rate Changes Effective July 1 2022 1113. What is the sales tax rate in Fulton County. 3 rows Fulton County GA Sales Tax Rate.

The county collection includes. Fulton County Tax Commissioner Dr. 141 Pryor Street SW.

The Fulton County Tax Commissioner is responsible for the collection of Property. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. Fulton County Sales Tax.

Sales Tax Breakdown. GA Sales Tax Rate. Fulton County sales tax is a rate of tax a consumer must pay when purchasing goods and some services in Fulton County Georgia and that a business must collect from their customers.

For sales of motor vehicles that are subject to sales and use tax Georgia law provides for limited exemptions from certain local taxes. The 85 sales tax rate in Atlanta consists of 4 Georgia state sales tax 26 Fulton County sales tax 15 Atlanta tax and 04 Special tax. OFfice of the Tax Commissioner.

The current total local. Upcoming quarterly rate changes. Georgia State Sales Tax.

Fulton County Sheriffs Tax Sales are held on the first. Inside the City of Atlanta in both DeKalb County and. The local sales tax rate in Fulton County is 3 and the maximum rate including Georgia and city sales taxes is 89 as of November 2022.

Georgia has state sales. Effective July 1 2021 Code 000 - The state sales and use tax rate is 4 and is included in the jurisdiction rates below.

Profile Of Metro Atlanta Metro Atlanta Demographics Overview

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

State Lodging Tax Requirements

Kemp Signs Law Suspending Georgia Gas Taxes Through May Wabe

Tax Rates Gordon County Government

Construction Contractors Georgia Sales And Use Tax Obligations Litwin Law

Fulton County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Georgia Tax Rates Rankings Georgia State Taxes Tax Foundation

Fulton County Schools Asks Voters To Ok Sales Tax Worth 1 2 Billion

How To Perform Line Level Tax Calculation For Sales Orders Dynamics 365 Business Central Forum Community Forum

How Healthy Is Fulton County Georgia Us News Healthiest Communities

Top 10 Housing Markets Most And Least Affordable In Q3 2022 Attom

Fulton County Tax Commissioner

Fulton County Georgia Homestead Exemption For Senior Residents Measure November 2022 Ballotpedia

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price